Gone are the days of wild user growth and expansive advertising revenue for Facebook. Earlier this month, Facebook’s Q4 earnings report catapulted the newly-christened ‘Meta’ into the biggest one-day wipeout in US stock market history. Meta’s stock sank by 26% and it’s market valuation plummeted by $230 billion. That’s the first such decline for the company in its 18-year history. It’s also the first time the company has reported a decline in daily active users (DAU) since its inception in 2004. Could this be a signal that Facebook Ads is on the decline as the consumer breakup with Facebook continues? ?

Facebook: Then & Now

From ‘likes’ to ad dollars: Facebook Ads Decline

Before Facebook became an advertising juggernaut, second only to rival Google in the duopoly, it wasn’t profitable. If you remember, it was only in 2012 that Facebook launched its IPO. With it came pressure from shareholders. Facebook had to turn its billion-plus users into a billions-of-dollars money engine. To do this, it launched a fleet of money-making initiatives and there was a clear winner from the start: its advertising business.

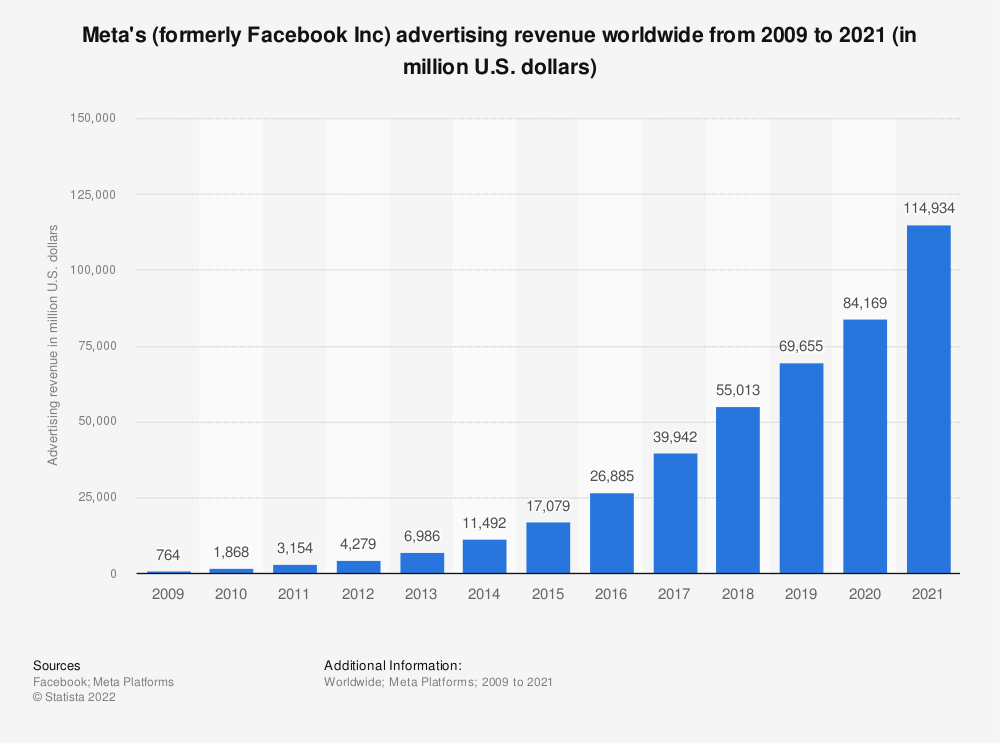

Today, the majority of the social network’s revenue comes from advertising. In 2021, Meta’s advertising business generated $114.934 billion in revenue. The majority of this advertising revenue comes from mobile devices.

Source: Statista

For comparison, Google drove $209.49 billion in advertising revenue in 2021. As the saying goes: “There’s Google, Facebook and everyone else.” The ad revenue generated by both companies surpasses the ad revenue generated by all other ad tech companies combined, hence the moniker ‘the duopoly’.

Building the wall: Facebook Ads Decline

While the term “walled garden” might conjure a charming medieval garden somewhere in Europe for some people, for those of us in ad tech, it’s a shorthand for Big Tech players in the duopoly; that is, Google and Facebook. In a broader sense, a “walled garden” is a closed platform or ecosystem where the technology provider has significant control over the hardware, applications, or content. In this sense, the definition also extends to proprietary device manufacturers like Apple. However, in advertising, what walled gardens have that’s proprietary is first-party data.

Source: QuanticMind

With 2.91 monthly active users (MAU) in the US in 2021, Facebook’s penetration rate of the US market is over 70%. This is a vast amount of data on the preferences and behavior of individuals in the US. It’s also a powerful tool for brands. It enables brands — large and small — to target users across Meta’s family of apps with relevant ads. Prior to iOS14, these users were often persistently logged into their Meta-owned and operated accounts across multiple devices. This gave Meta access to the deterministic data needed to target users across devices with a high level of attribution accuracy.

Less walls, more privacy: Facebook Ads Decline

When Apple announced in 2020 it would be enhancing consent-based data privacy controls on iOS14, nerfing its unique identifier; none of us in the ad tech space were surprised. Unfortunately for Facebook, which is not a walled garden of both first party data and proprietary hardware — like its rival duopolist, Google — it also meant the end of unmediated access to deterministic data.

Of course, in response to Apple’s privacy changes, Facebook launched a massive ad campaign in defense of personalized advertising. The social media giant has developed an over dependence on unique identifiers like the IDFA and GAID. With this dependence has also come an over dependence on deterministic versus probabilistic data, which is more nuanced and complex as it relies — as the name suggests — on probability.

Context is key: Facebook Ads Decline

To target users based on probabilistic data, information is collected anonymously by gathering data points on users’ browsing behavior and comparing them to deterministic data points. Probabilistic data modeling identifies users by matching them with a known user who exhibits similar browsing behavior. Players can aggregate these data points and plug them into algorithms to build detailed audience profiles from incomplete information. This enables data gathering and targeting that respects users’ privacy and functions in correlation to their consent.

The new titans of ad tech

The ad tech industry has never been a static space. Even prior to iOS14 the ecosystem was shifting, but the rising tide of data privacy controls has accelerated that shift. In response to the deprecation of the IDFA, smaller players have merged and consolidated to create new titans of ad tech. These emerging players have built out functionality far beyond traditional ad networks, incorporating supply and demand-side platforms, ad exchanges, attribution capabilities, creative services, analytics, and more.

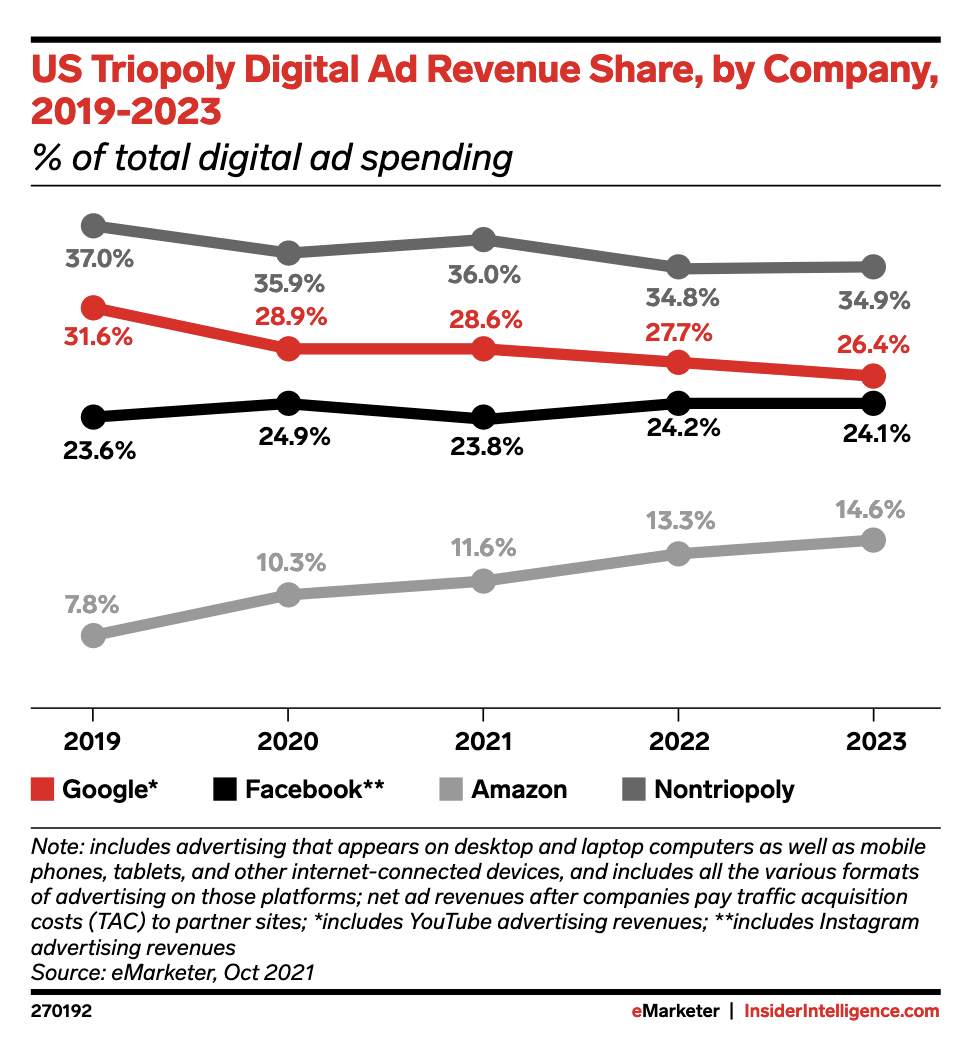

This is not to say that Meta does not still hold the second-largest share of the advertising market. But, it’s clear their stronghold is waning. By 2023, Meta’s share of digital ad revenue will fall to below 2020 levels (24.1%). As alternative players emerge, like Amazon, more and more of Meta’s market share will be at risk. For a walled garden like Meta that has never played on the same ground as the rest of the ad tech ecosystem, it’s no wonder that major plays for still fictional lands like the metaverse are being gambled on.

Source: eMarketer

Takeaways on Breaking Up With Facebook & Facebook’s Ad Decline

When it comes to getting your brand noticed, Facebook and Google are not the only game in town anymore. Today, there is more competition than ever from independent demand-side suppliers. These emerging DSPs have their own reserves of robust first-party data. They also have the agility to build out the contextual targeting needed to keep pace with enhanced data privacy controls. Going forward, new battles loom of how the content and assets of these new, vertically and horizontally-integrated titans of ad tech competes with the very customers they serve.