Welcome to another installment of our Pulse on Current App Trends report! Every month we round up the key insights on app trends from the previous month to help you better market your app. In this report we’re reviewing overall H1 2021 trends including global app revenue, downloads and top apps.

Q2 2021 App Spend Breaks Records

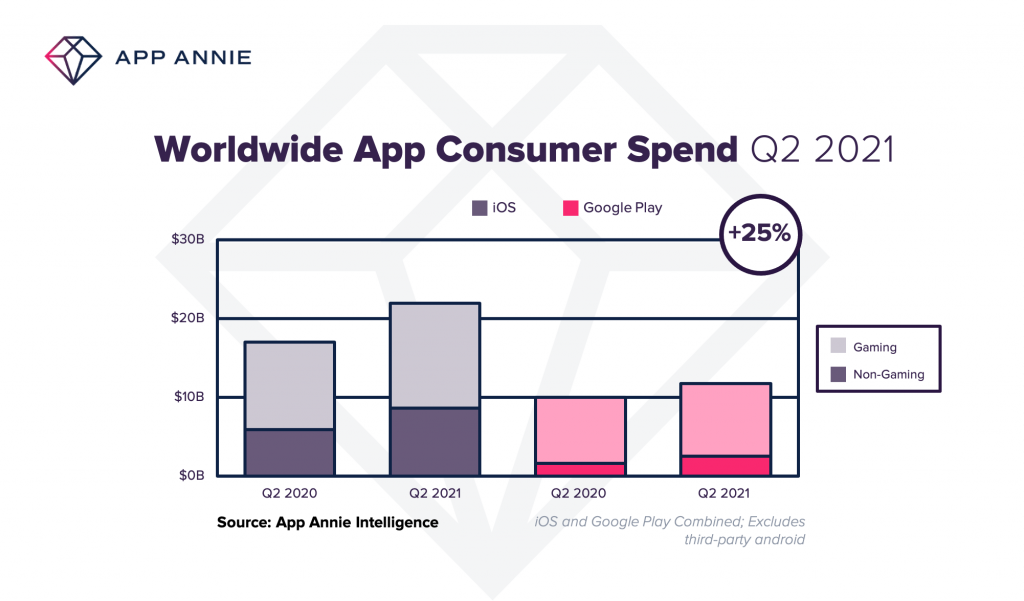

Another quarter, another round of record-breaking performance in the app economy. In Q2 2021, apps drove $34 billion in revenue. This represents an increase of $7 billion year-over-year and $2 billion quarter-over-quarter.

Broken down by app store, spend on iOS leapt 30% year-over-year to $22 billion. On Google Play, spend grew 20% to around $12 billion.

Source: App Annie

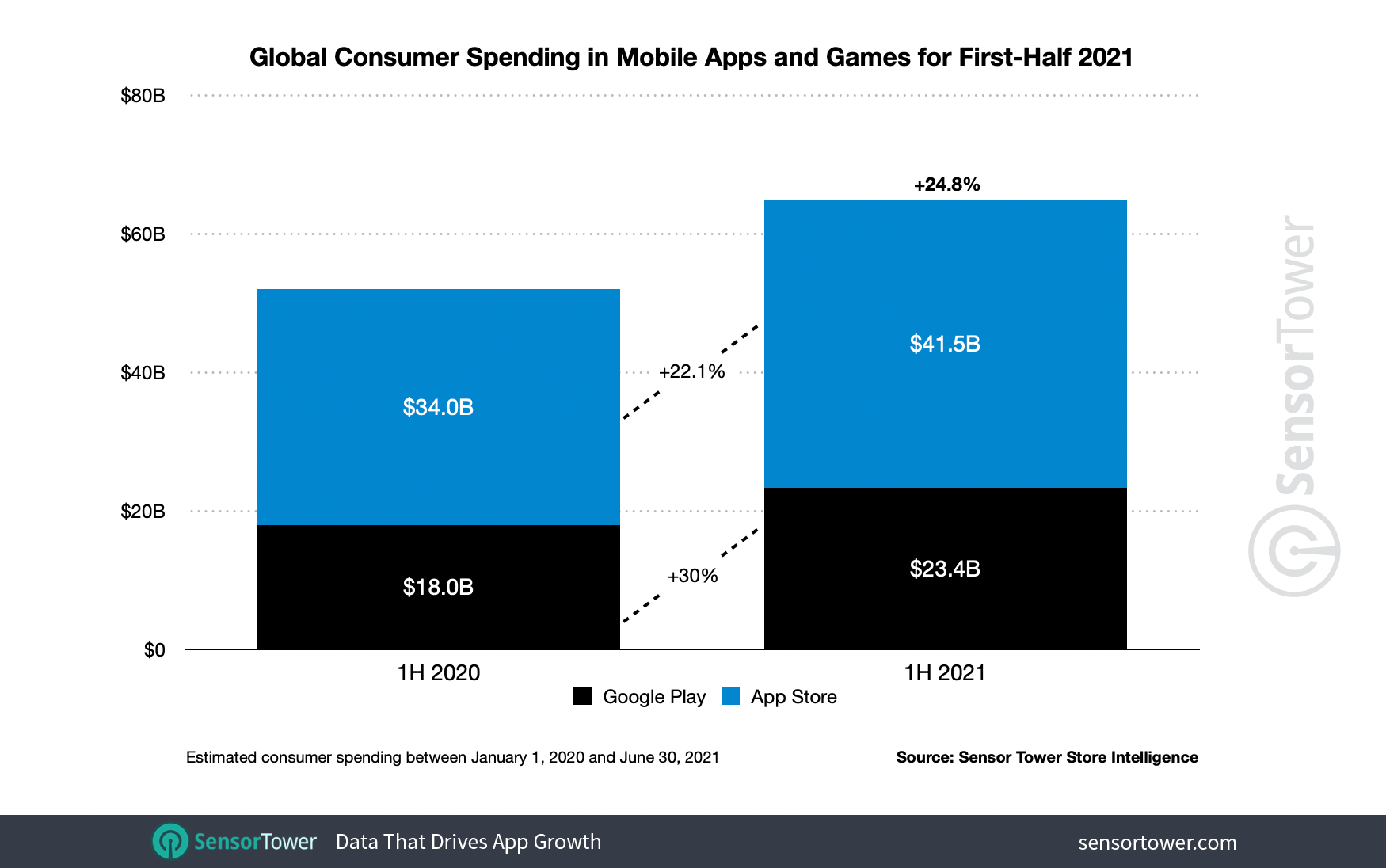

Overall, in the first half of 2021, worldwide consumer spending in mobile apps reached $64.9 billion across the App and Google Play stores. This is a 24.8% increase from the $52 billion generated by both stores in the same period in 2020.

By app store, spend from in-app purchases, subscriptions, and premium apps and games on iOS generated $41.5 billion. This is about 1.8x the revenue generated by Android apps, which drove $23.4 billion in the same period.

Google Play store’s revenue growth year-over-year outpaced Apple’s App store. In the first half of 2021, the App Store’s revenue grew over 22% from the same period last year. On the other hand, Google Play Store’s revenue grew 30% in the same period. This is largely due to the mobile growth of emerging markets such as the Philippines, where COVID19 has continued to sustain business closures and quarantines.

Source: Sensor Tower

App Spend Shows Changing Mobile Habits Are Here to Stay

Although spending continued to climb to new heights quarter-over-quarter throughout H1 2021, year-over-year growth trailed the outsized growth of the app economy in 2020. Specifically, in the first half of 2020, the pandemic boosted consumer spend by over 28% year-over-year compared to the $40.5 billion generated in the first half of 2019.

The numbers reflect two takeaways: first, the app economy continues to be healthy and booming. Second, the sustained increase in app revenue quarter-over-quarter indicates that users are still spending in apps at the same rate (if not more) despite easing lockdown restrictions. Stay-at-home orders prompted by the global pandemic in 2020 certainly changed people’s habits to engage with apps more frequently in their everyday lives. The data from 2021 so far seems to suggest that this habit is not going away.

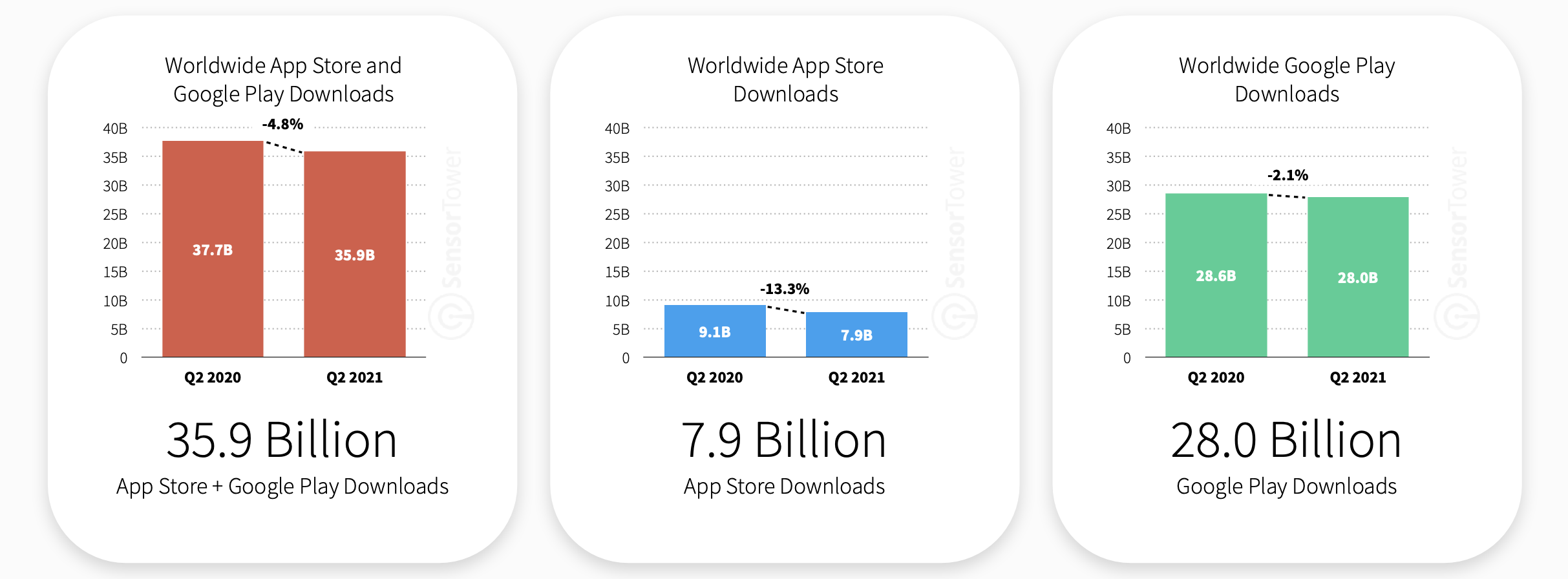

Q2 2021 App Downloads Slow

While worldwide app spend grew, worldwide app downloads slowed. Total global app installs in Q2 2021 totaled just under 36 billion. This represented a 4.8% year-over-year decrease from the tremendous growth of app downloads in the same period in 2020. In Q2 2020, users installed 37.7 billion apps overall.

By app store, iOS downloads fell 13.3% to 7.9 billion. Google Play downloads dropped 2.1% to 28 billion.

Source: Sensor Tower

App Downloads Reflect an Maturing Mobile Market

With the slowdown in app downloads, it’s clear we are entering a more mature phase of the app economy. As users zero in on the apps that derive authentic value in their lives, it makes sense they would download fewer apps and spend more time (and money) in the ones they use the most. This is also reflected in the data, which shows growth in app usage and consumer spend, versus app installs.

Also interesting is the relative slowdown of Android app downloads versus iOS app downloads. It seems the extensive saturation of Android devices worldwide has resulted in less of a slowdown on Android despite the global saturation of mobile devices overall. On the other hand, iOS downloads show a greater impact from the maturing mobile marketplace since Apple devices are used less globally and less in emerging markets. The greater relative slowdown in iOS installs could also be attributed to recent iOS14.5+ data privacy impacts.

Top Apps in Q2 2021

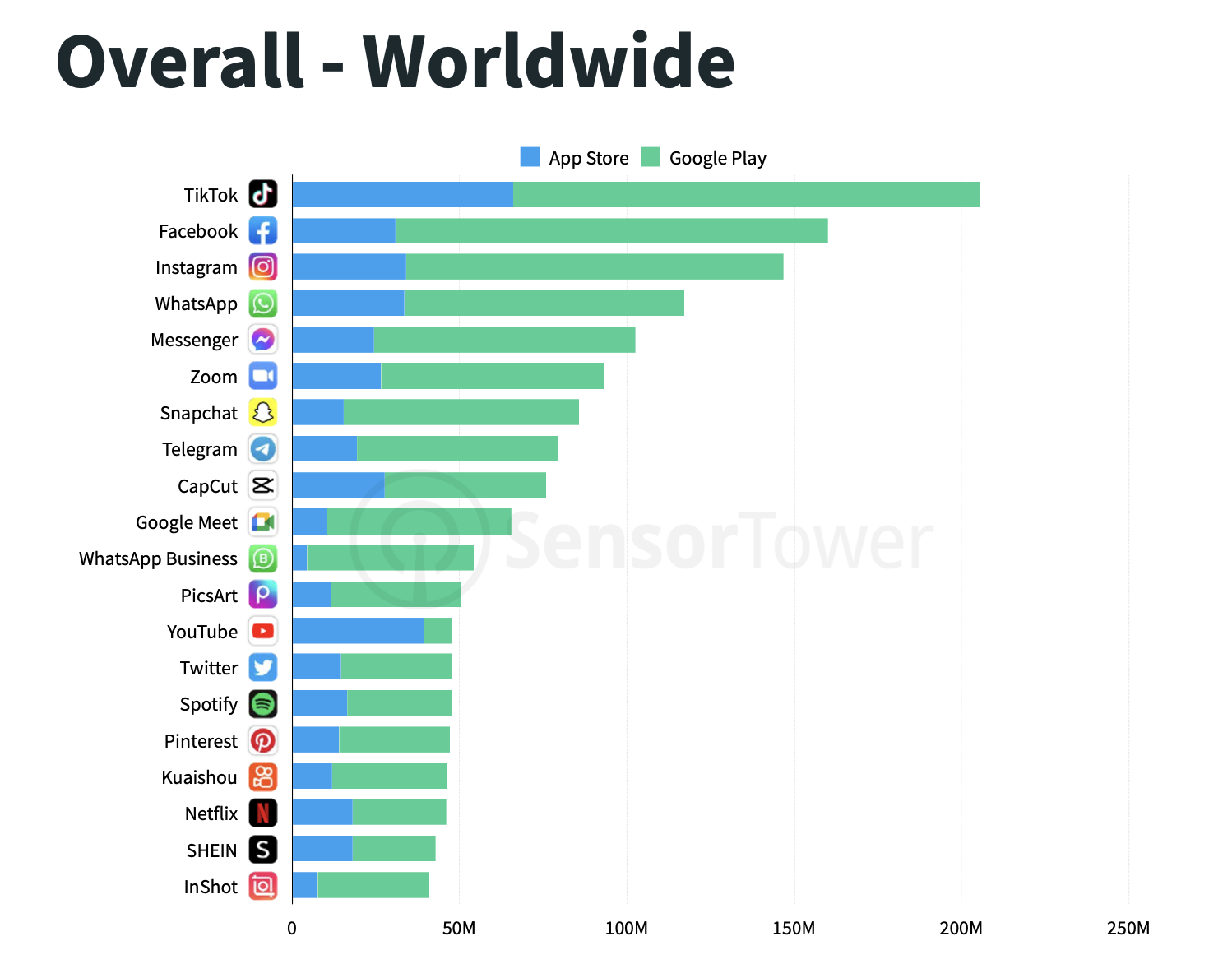

Most Downloaded Non-Gaming Apps

No surprises here, TikTok was the top app in global downloads overall in Q2 2021 and H1 2021. The video sharing app from ByteDance has maintained it’s No. 1 spot as the most-downloaded app in 5 out of the last 6 quarters since Q2 2020.

The rest of the top 5 most-downloaded apps were from Facebook including the Facebook app, Instagram, WhatsApp and Facebook Messenger.

Source: Sensor Tower

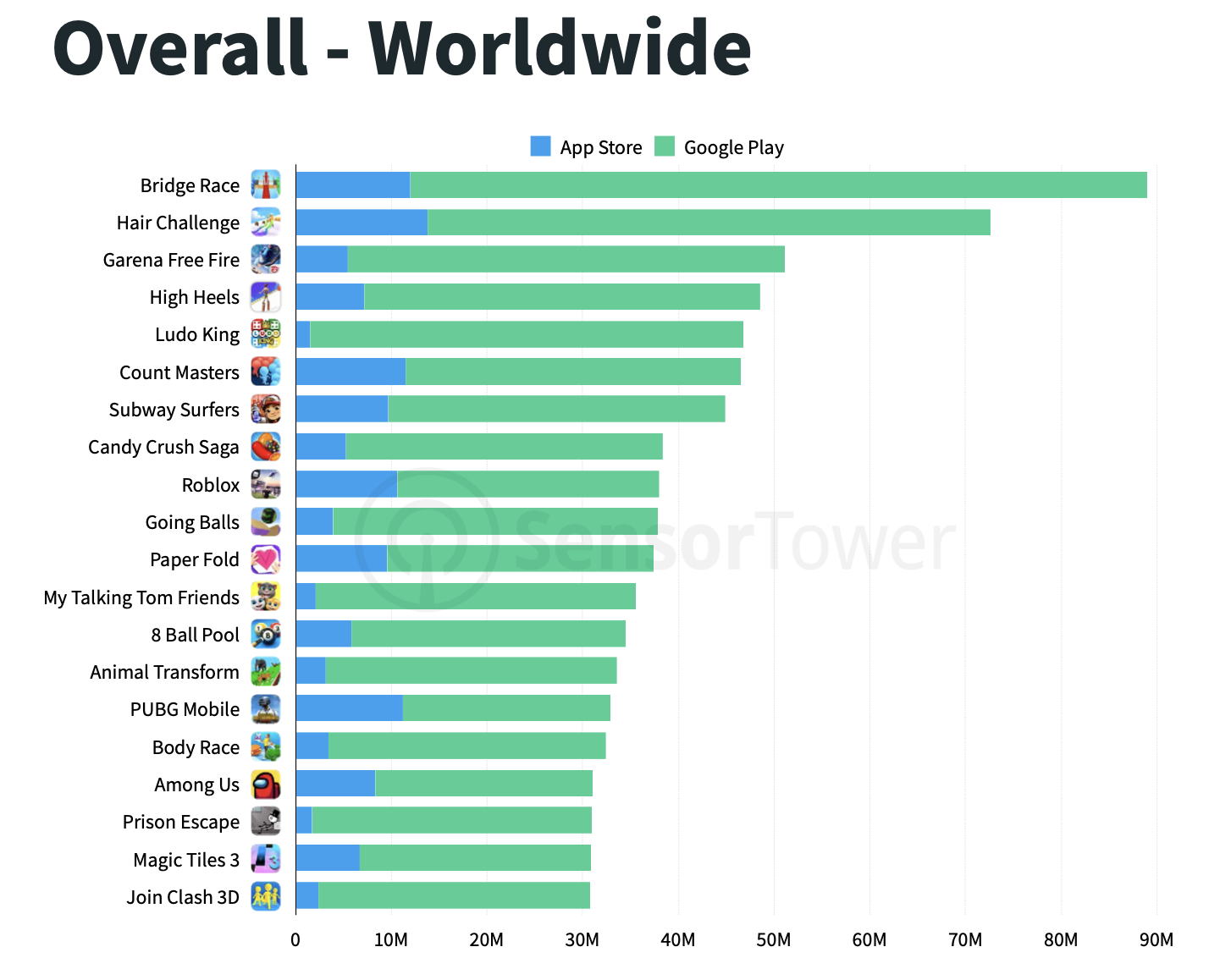

Most Downloaded Gaming Apps

Bridge Race from Supersonic Studios was the most downloaded mobile game app globally in Q2 2021. Zynga’s Hair Challenge and High Heels also came in in the top five most-downloaded games. Hair Challenge and High Heels’ breakout popularity, specifically, reflects the rise of the fashion games genre.

Source: Sensor Tower

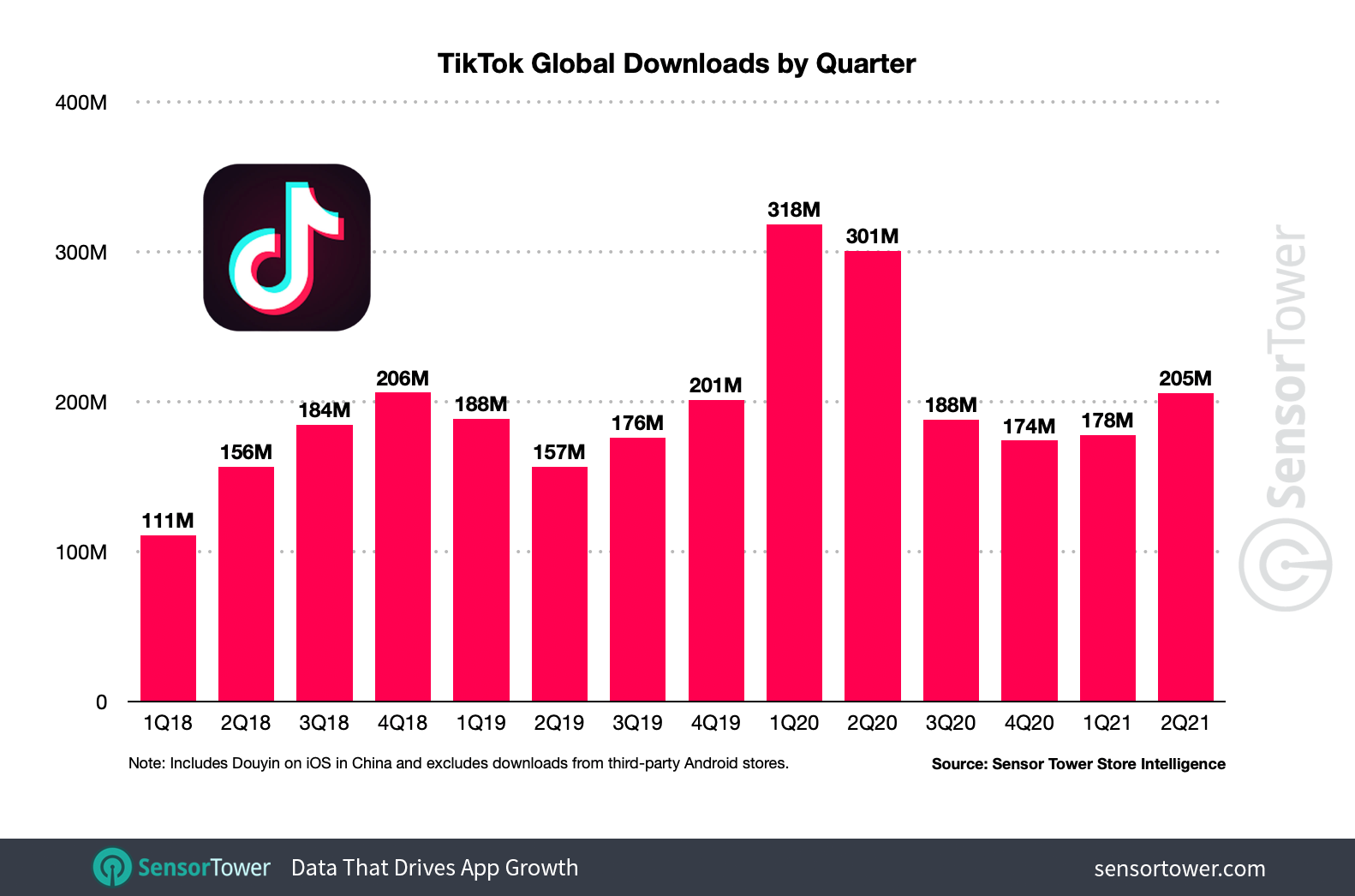

Top App Spotlight: TikTok

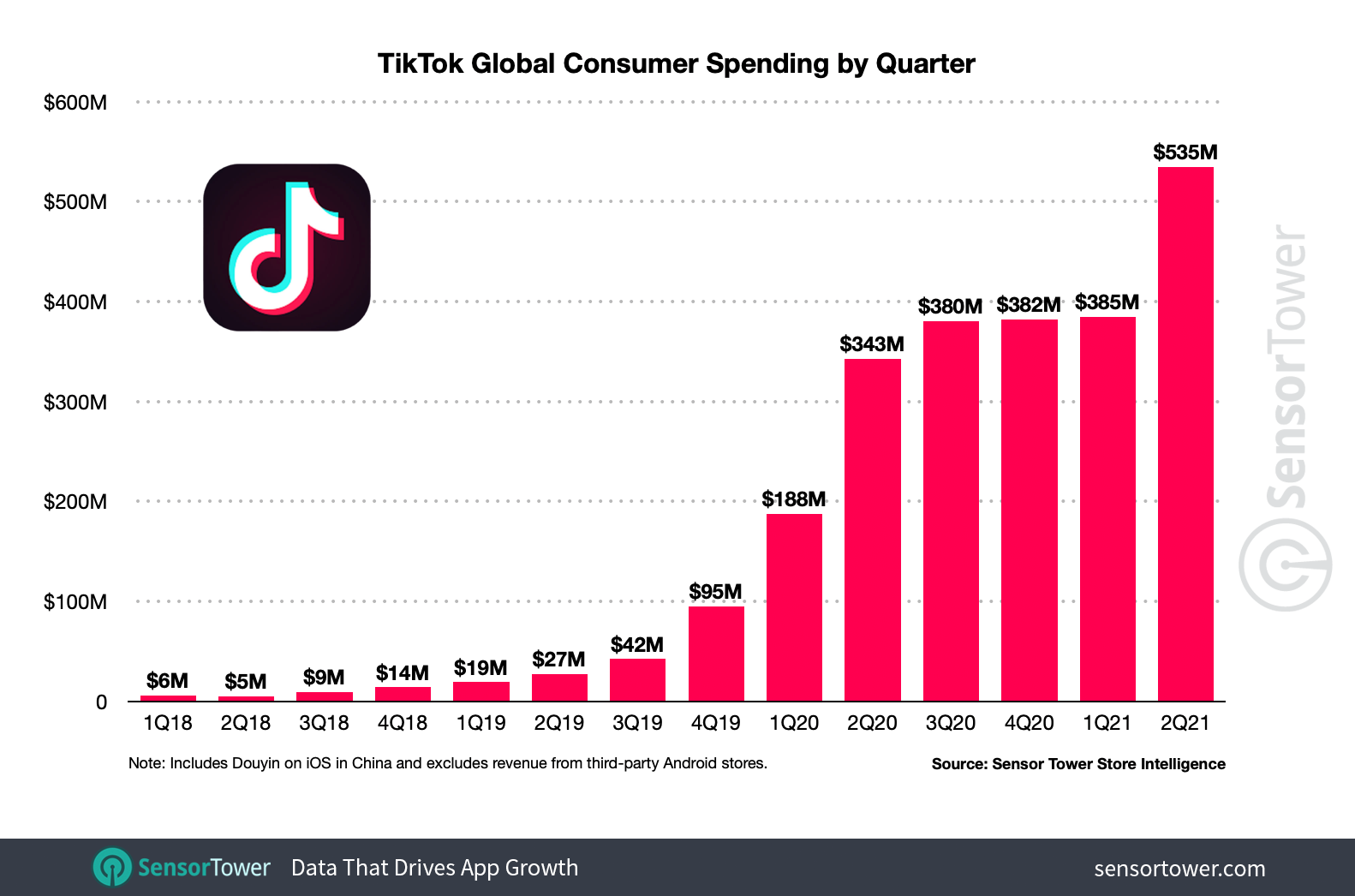

TikTok was the most downloaded and highest grossing non-game app globally in the first half of 2021. The video-sharing app from ByteDance generated nearly 383 million first-time installs and an estimated $919.2 million in consumer spending.

Source: Sensor Tower

Specifically in Q2 2021, TikTok saw its greatest quarter-over-quarter growth in consumer spending since Q2 2020. The app drove $534.6 million in consumer spend, 39% more than the previous quarter.

Source: Sensor Tower

TikTok’s installs also accelerated in 2021. First-time downloads of the app climbed 16% quarter-over-quarter to 205.4 million in Q2 2021. This is the most growth the app has seen since its record-breaking performance in Q1 2020 when it generated more than 315 million installs, the most any app has seen in a single quarter.

Since its launch, TikTok has generated 3 billion installs, breaking records as the first non-Facebook app to hit the 3 billion install milestone. To date, only 4 other apps have achieved this growth, all of which are owned by Facebook: WhatsApp, Facebook Messenger, the Facebook app and Instagram.

In terms of revenue, TikTok has surpassed $2.5 billion since its launch. Only 4 other apps have seen more than $2.5 billion in gross revenue historically: Tinder, Netflix, YouTube and Tencent Video.

Takeaways

In this installment of our Pulse on Current App Trends report, we reviewed Q2 2021 trends, including global app revenue, downloads and top apps.

- In Q2 2021 apps drove $34 billion in revenue. This represents an increase of $2 billion quarter-over-quarter and $7 billion year-over-year.

- Broken down by app store, spend on iOS grew 30% year-over-year to $22 billion. On Android, spend leapt 20% to around $12 billion.

- Overall for H1 2021, worldwide consumer spend in mobile apps reached $64.9 billion. This is a 24.8% increase from the $52 billion generated by both stores in the same period in 2020. The data reflects that the increase in consumer mobile usage due to the pandemic is here to stay.

- While worldwide app spend grew, worldwide app downloads slowed. Total global app installs in Q2 2021 totaled just under 36 billion. This represented a 4.8% year-over-year decrease and reflects a maturing mobile market.

- TikTok was the top non-gaming app in global downloads overall in Q2 2021 and H1 2021. TikTok has also become the 5th and only non-Facebook app in history to reach 3 billion installs.