The European app market is thriving. In fact, in 2021, European consumers spent 22.8% more in apps than they did the year before. We look at the top trends and popular apps in the European app market for apps looking re-engage users in Europe. Keep in mind, these trends are changing with the ongoing conflict in Ukraine.

The European App Market

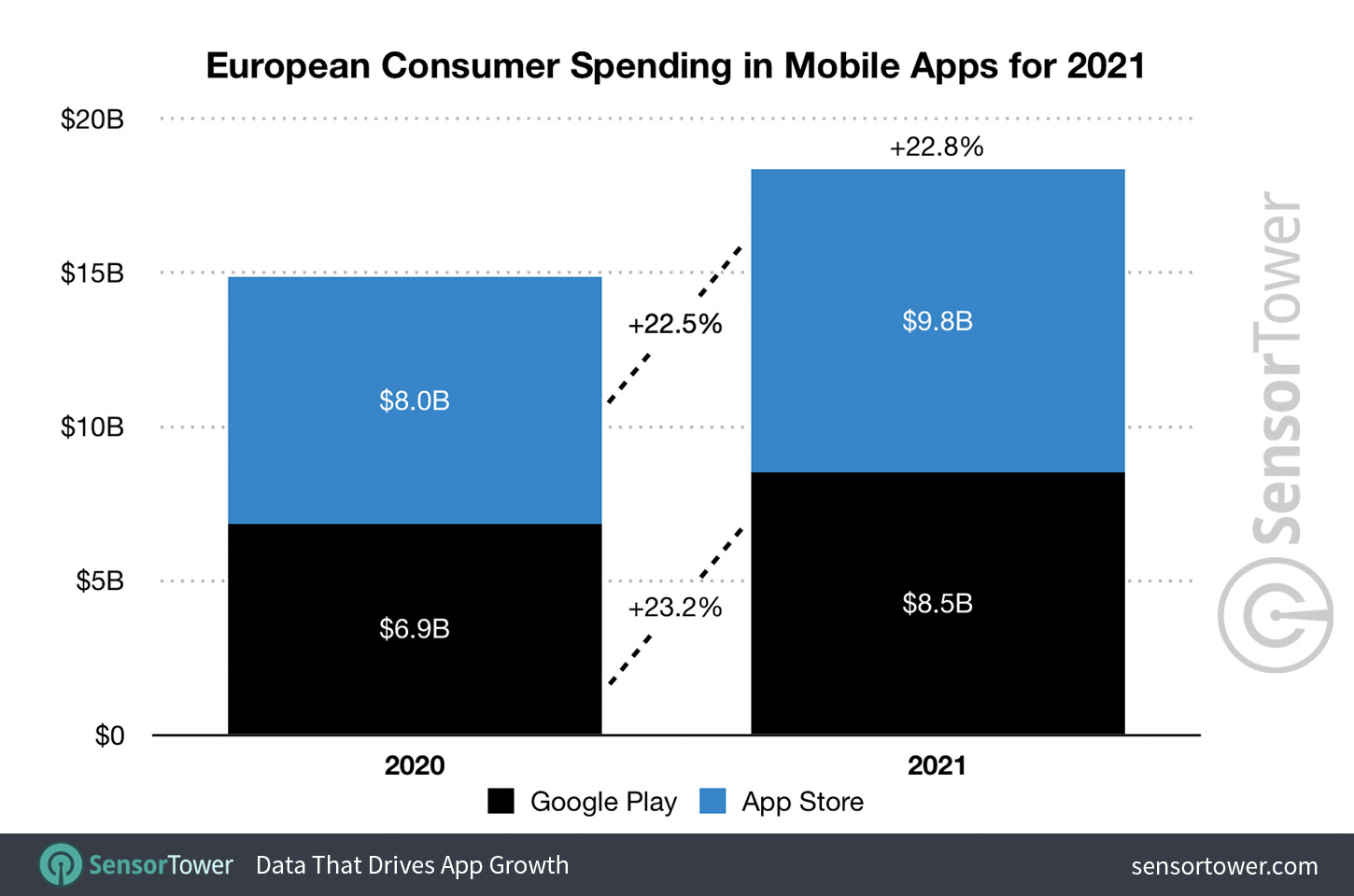

European consumers spent an estimated $18.3 billion across the App Store and Google Play in 2021. As mentioned above, this represents a 22.8% year over year increase. Overall, the European app market made up 14% of global app revenue generated in 2021.

Source: Sensor Tower

The App Store drove more of this revenue than Google Play. The App Store accounted for 53.5% of user spending in Europe. Google Play made up the remaining 46.5%.

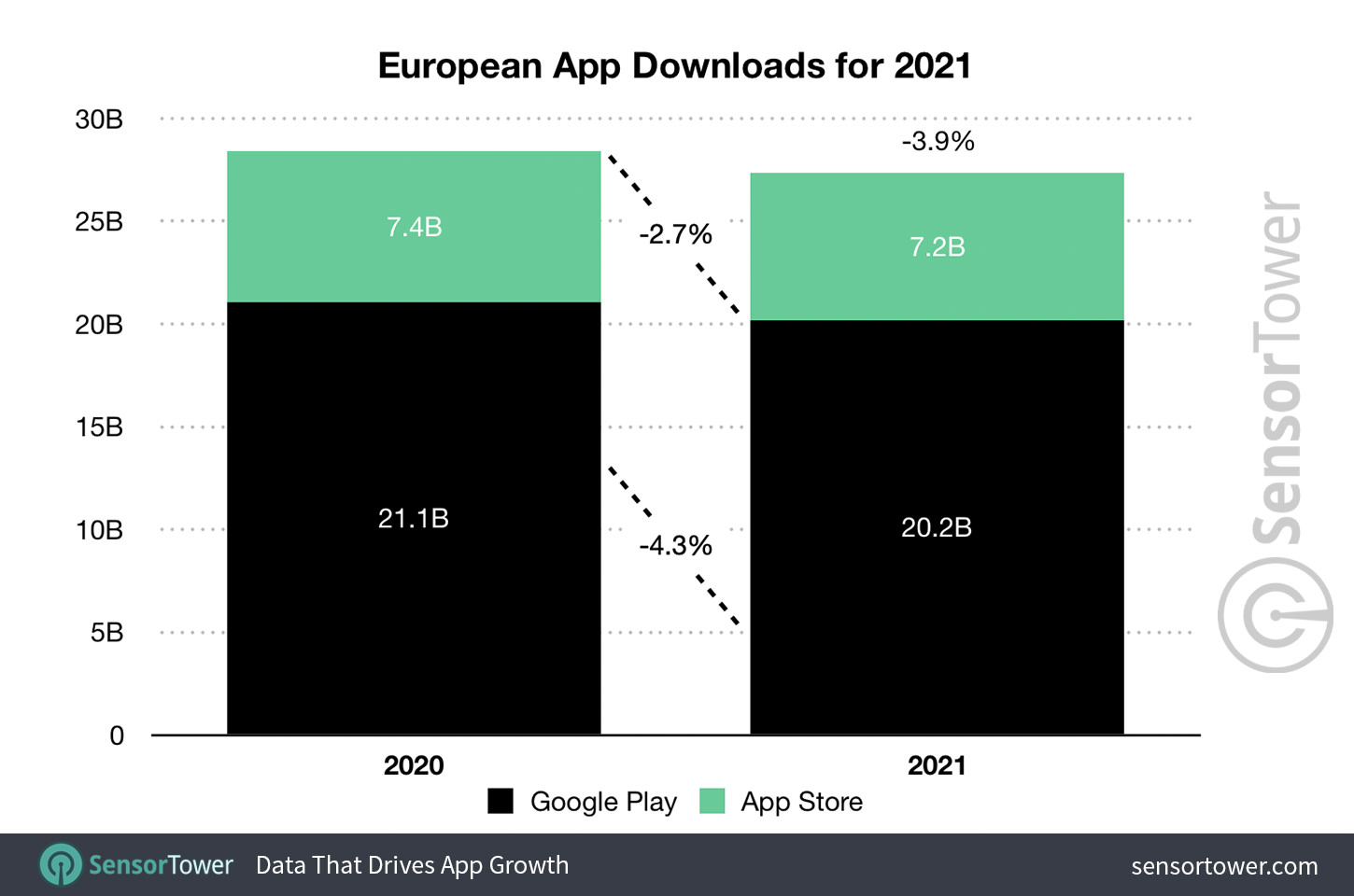

When it comes to downloads, that performance was flipped (as is usually the case in the global app market) for the popular apps in Europe. Google Play drove 20.2 billion downloads while the App Store drove 7.2 billion. Overall downloads declined year-over-year for both stores. Google play saw a 4.3% decline in installs while the App Store saw a 2.7% drop.

Source: Sensor Tower

European Game App Market

Game app performance in Europe popularly followed overall EU app market trends. Namely, there was an increase in overall revenue and a decrease in overall app downloads.

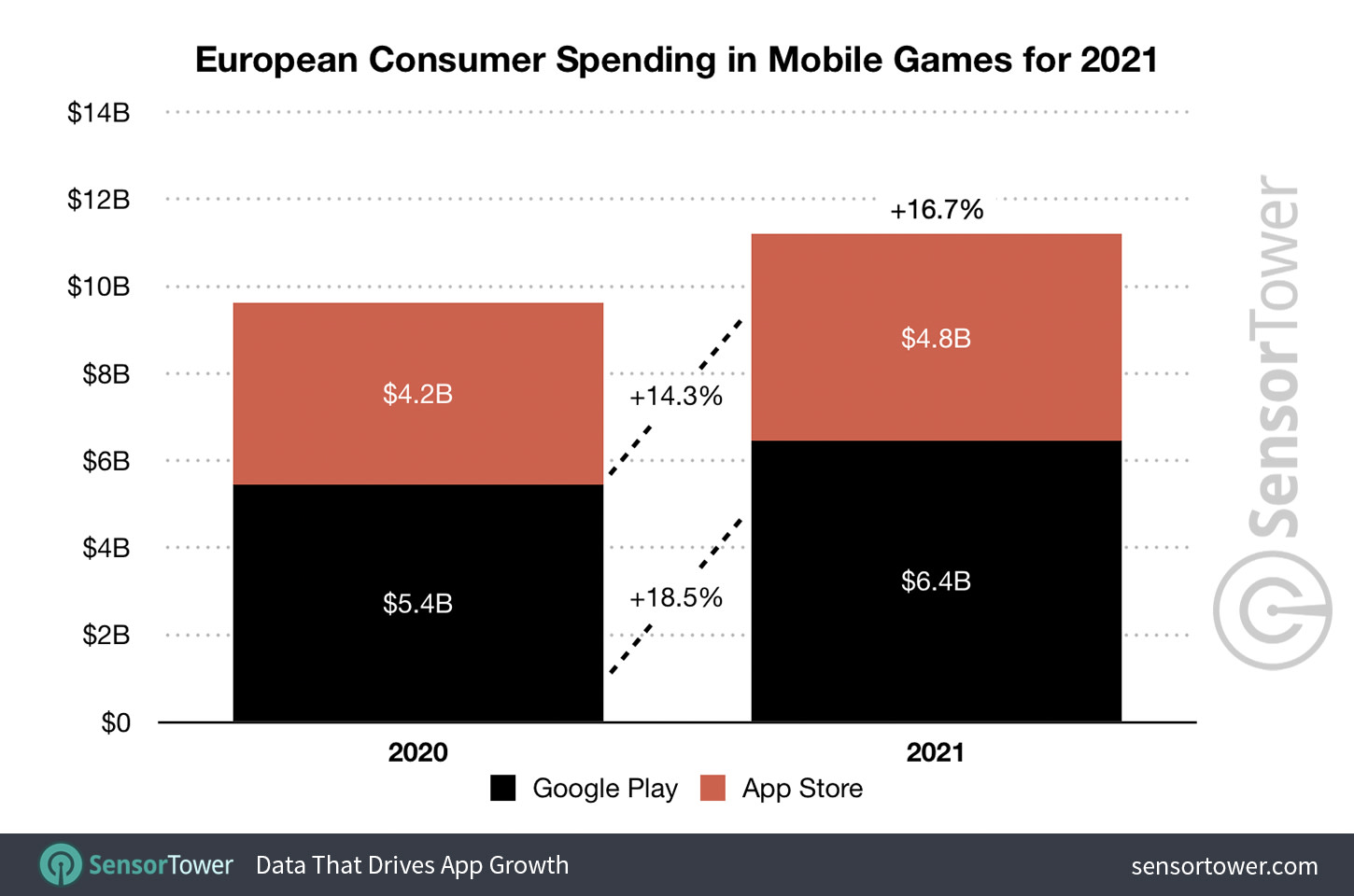

In total, mobile games generated $11.2 billion in Europe in 2021. This represented a 16.7% year over year increase.

Source: Sensor Tower

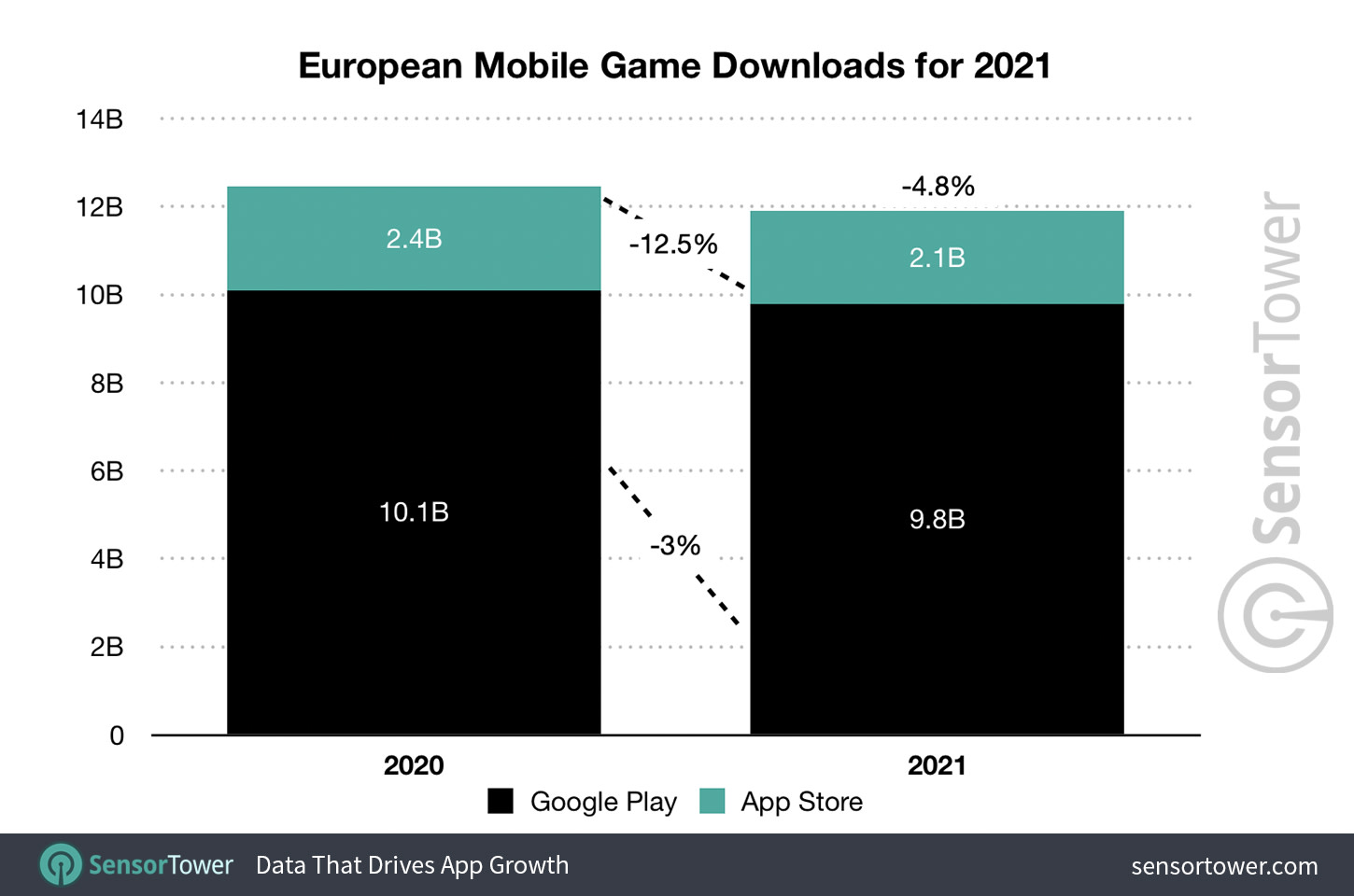

Mobile games generated 11.9 billion downloads in 2021. That represented a slight decrease (4.8%) from 2020. The Google Play store dominated in both revenue and downloads.

Source: Sensor Tower

Game app revenue accounted for 61% of total mobile app revenue in Europe. That share of revenue declined slightly from 2020 when games made up 64.8% of total European app revenue. Overall, European player spending accounts for 12.7% of the global game app market.

European App Trends

What apps are European users engaging with and where are these users mostly located? We cover the trends marketers looking to retarget users in the European market should know to better optimize their ad spend.

Top Popular Apps in Europe Apps by Revenue

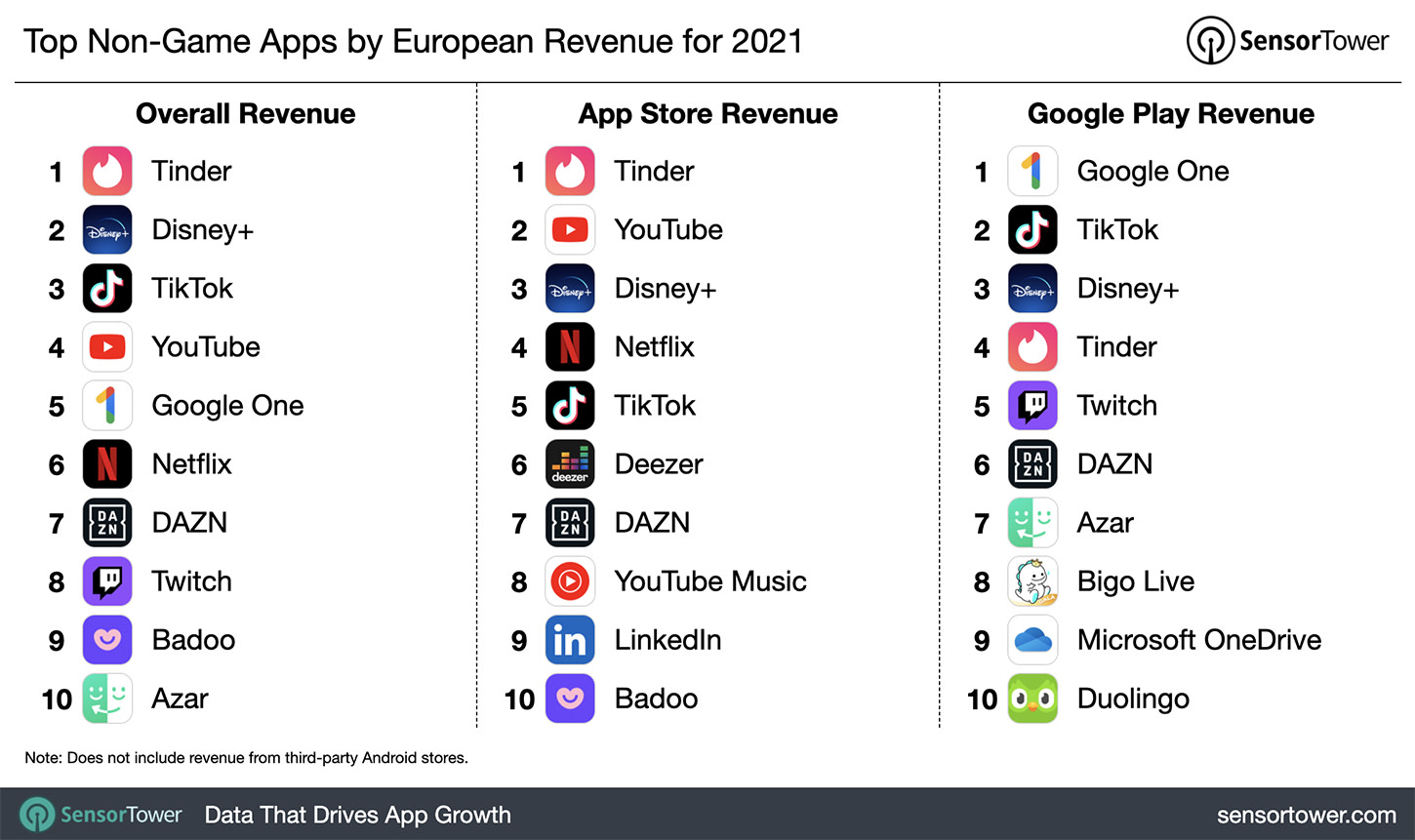

Dating app, Tinder, generated the most revenue of any non-gaming app in Europe in 2021. Tinder drove $392 million in user spend, followed by Disney+ and TikTok.

Source: Sensor Tower

In particular, dating and social discovery apps have seen a marked increase in usage in Europe in the past 3 years. Europeans spent more than $780 million on dating apps in 2021. According to Sensor Tower, Europeans are set to spend more than $200 million on Dating and Social Discovery in-app purchases in Q1 2022 alone. This amounts to about $1,600 per minute.

Top Popular Apps in Europe Apps by Downloads

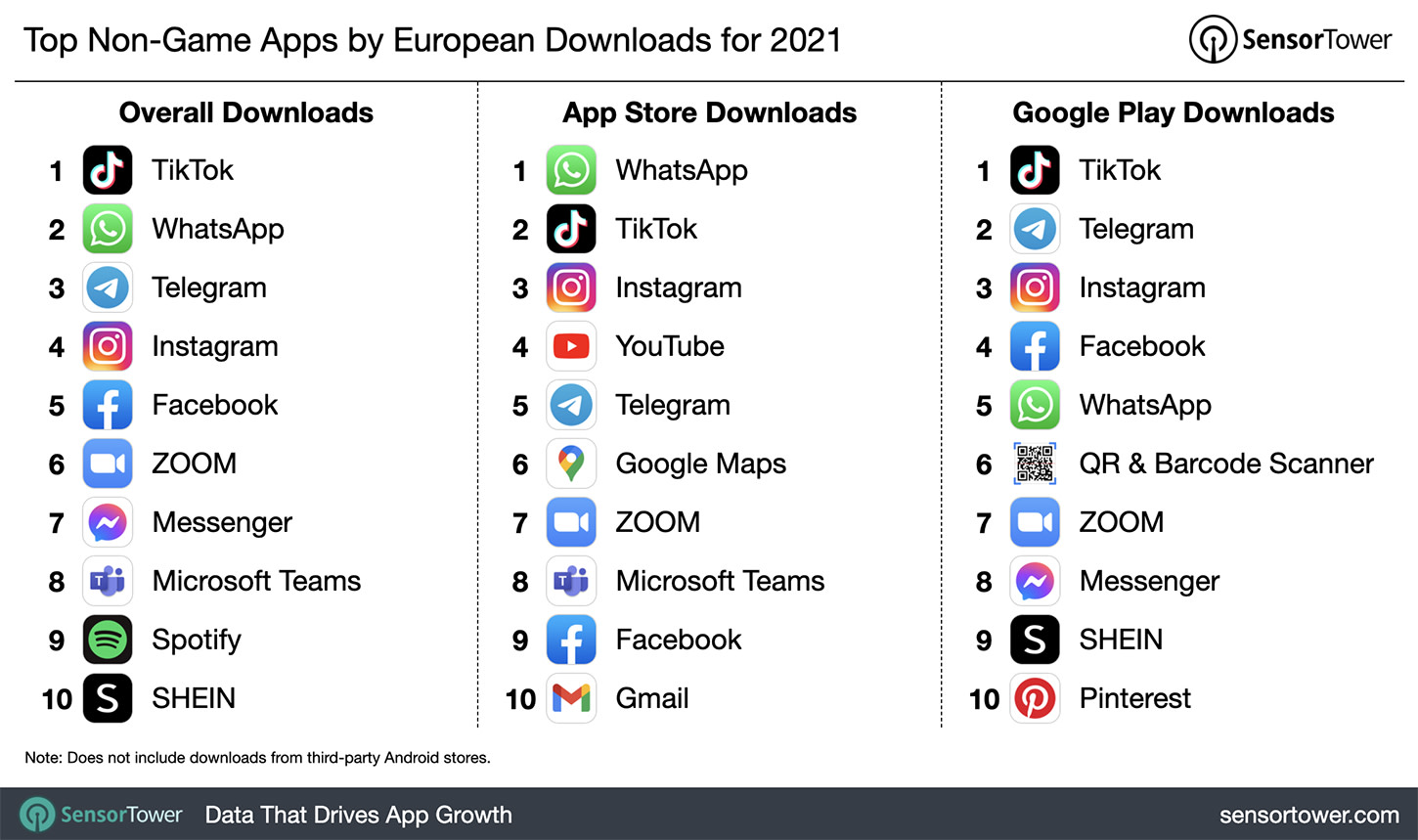

TikTok was the most downloaded app in Europe. The video-sharing app generated 102 million installs. This was followed by messaging apps, WhatsApp and Telegram. In particular, secure messaging app, Telegram, rose 7% in revenue in 2021, showing that concerns about privacy, information and data were top of mind for the European user.

Source: Sensor Tower

Popular Markets for Apps in Europe

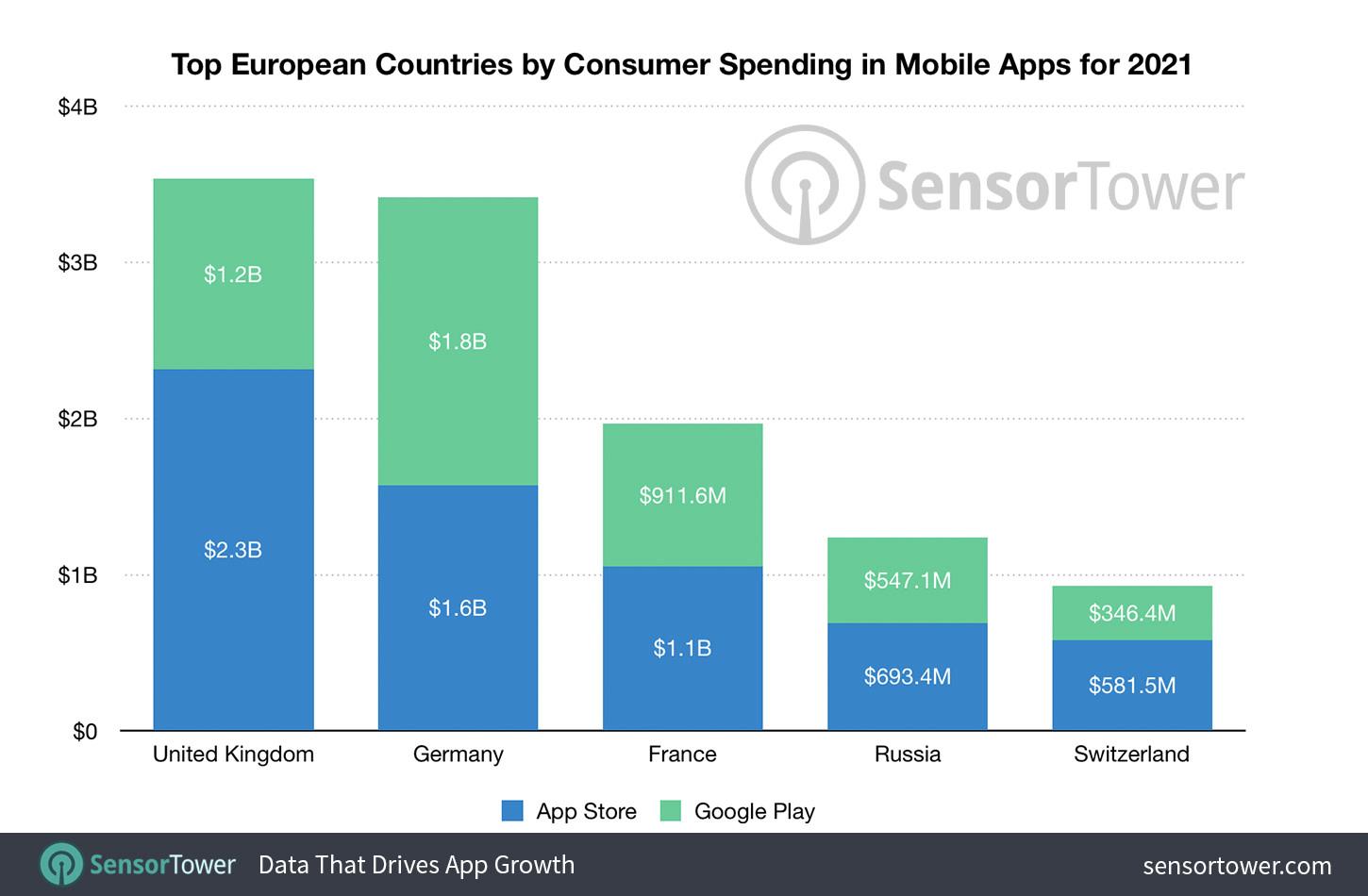

The most profitable European country in terms of app revenue is the United Kingdom. The UK drove the most app revenue in 2021 at $3.5 billion. This represented a 23.2% increase year over year. Germany followed at $3.4 billion. Third top market was France at $2 billion.

Source: Sensor Tower

In terms of downloads, Russia led the European region with 5.9 billion installs last year. This represented a slight dip from 2020 (2.5%). Next was Turkey at 3.9 billion installs.

Top Market: United Kingdom

According to Data.ai’s 2021 State of Mobile report, the UK was the fifth-highest generating country when it comes to overall consumer app spending. The top non-gaming apps that UK users spent in were Disney+, Tinder and YouTube in 2021. For Tinder users specifically, in the UK, they tend to be male and fall in the Gen Z age group. The apps with the highest monthly active users (MAU) were all Meta-owned: Whatsapp, Facebook and Facebook Messenger.

The top gaming app across revenue, downloads and MAU in the UK is ROBLOX. In terms of consumer spend, this is followed by Coin Master and Candy Crush Saga. In terms of MAU, this is followed by Among Us! and Pokémon Go.

Top Market: Germany

Germany was the sixth-highest generating country in consumer spending. The top non-gaming apps in which German users made the most purchases in 2021 were Tinder, Disney+ and sports media app, DAZN. The apps with the highest MAU were Whatsapp, Facebook and Amazon.

For popular gaming apps in this European market, Coin Master drove the most in consumer spend, followed by State of Survival and Gardenscapes. In terms of MAU, the top game was ROBLOX, followed by Pokémon Go and Candy Crush Saga.

It should also be noted that Germany was a key driver for overall mobile game revenue in Europe. Germany drove more player spend than the UK (No. 2) and France (No. 3). Most of that revenue was generated by Android users.

Top Market: France

In the rundown of top markets by global spend, France came in tenth. The top non-gaming apps in which French users made purchases were music app, Deezer, Disney+ and Tinder. The apps with the highest MAU were Whatsapp, Facebook and Facebook Messenger.

In terms of popular gaming apps in Europe for this market, Coin Master drove the most in consumer spend, followed by Brawl Stars and Clash of Clans. In terms of MAU, the top game was FDJ, followed by Candy Crush Saga and Pokémon Go.

Takeaways on App Popularity in Europe

The European market represented 14% of global app revenue in 2021. While the split between App Store and Google Play differs for specific countries, overall, the majority of European app revenue was generated by users on iOS devices.

- For all apps: European users spend a significant amount on dating and social discovery apps. Making a purchase or subscribing to an app incentivizes higher engagement and session times. That being said, apps looking to re-engage active European users should consider advertising in dating apps.

- For game apps: The Google Play store drove a majority of game app revenue and downloads in Europe in 2021. Shift retargeting spend to Android and focus on top markets (Germany, UK and France).

Looking to engage European users in 2022?

Need support engaging European users in your retargeting strategy? Reach out to us for support planning your app’s mobile marketing strategy in 2022 and beyond for maximum retention!